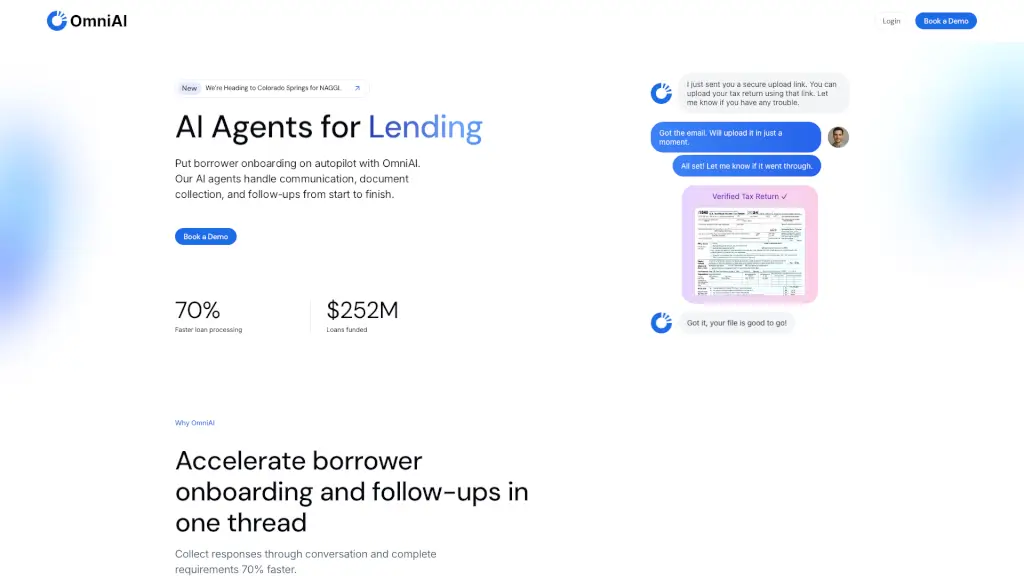

What is OmniAI?

OmniAI is a game-changer for the lending industry, designed to streamline borrower onboarding and make the entire process smoother and faster. Imagine having AI agents that handle all the communication, document collection, and follow-ups with borrowers, from start to finish. This means your team can focus on more important tasks while OmniAI takes care of the nitty-gritty. With 24/7 availability and multilingual support, OmniAI ensures that borrowers are always in the loop, reducing drop-offs and speeding up loan processing.

What are the features of OmniAI?

- Conversational Onboarding: Borrowers can reply by SMS or email, and OmniAI reads, verifies, and autofills every field, making the process 70% faster.

- Document Collection: Automatically collect and verify documents like utility bills, rent rolls, and financial statements, ensuring everything is in order.

- Compliance Guardrails: Every interaction is logged, providing a clear, audit-ready history, and maintaining 100% audit-trail coverage.

- 24/7 Borrower Assistant: Multilingual SMS and email follow-ups keep borrowers engaged and moving forward without constant team oversight.

- Unified Data Network: Instantly run soft credit checks, link bank accounts, and verify income with integrations like Plaid, Experian, and TransUnion.

- Security & Privacy: Built with security in mind, including private cloud options, SOC 2 compliance, and role-based access control.

What are the use cases of OmniAI?

- Mortgage Lending: Speed up the mortgage application process by automating document collection and follow-ups.

- Small Business Loans: Simplify the onboarding process for small business loans, reducing the time from application to funding.

- Equipment Financing: Streamline equipment finance reviews, cutting down review times and improving decision-making speed.

- Consumer Loans: Enhance the consumer loan experience by automating communication and document verification.

- Auto Loans: Make the auto loan process smoother and faster, with automated follow-ups and document collection.

How to use OmniAI?

- Set Up Your Account: Sign up for OmniAI and configure your account settings, including integrations and user permissions.

- Create a New Loan Application: Start a new loan application and input the borrower's basic information.

- Initiate Communication: Let OmniAI take over, sending out the first message to the borrower via SMS or email.

- Monitor Progress: Keep an eye on the dashboard to track the progress of each application and see which documents are still needed.

- Review and Approve: Once all documents are collected and verified, review the application and approve the loan.