Casca automates loan origination, improving efficiency and conversion rates for banks and lenders.

Best Cascading AI Alternatives & Competitors 2026

A popular AI For Finance tool with 16.9K monthly visits. We've analyzed 11 similar AI tools to help you compare features, popularity, and ratings. Find the perfect alternative for your needs.

Quick Comparison

(Top 5 by Traffic)| Tool | Visits | Top Market | Growth | Rating | Insight | Description |

|---|---|---|---|---|---|---|

Cascading AICurrent | 16.9K | 🇺🇸 United States46.9% | +31.9% | - | 📊Steady Growth Recent growth of 32%. Product is in a healthy upward trend. | Casca automates loan origination, improving efficiency and conversion rates for banks and lenders. |

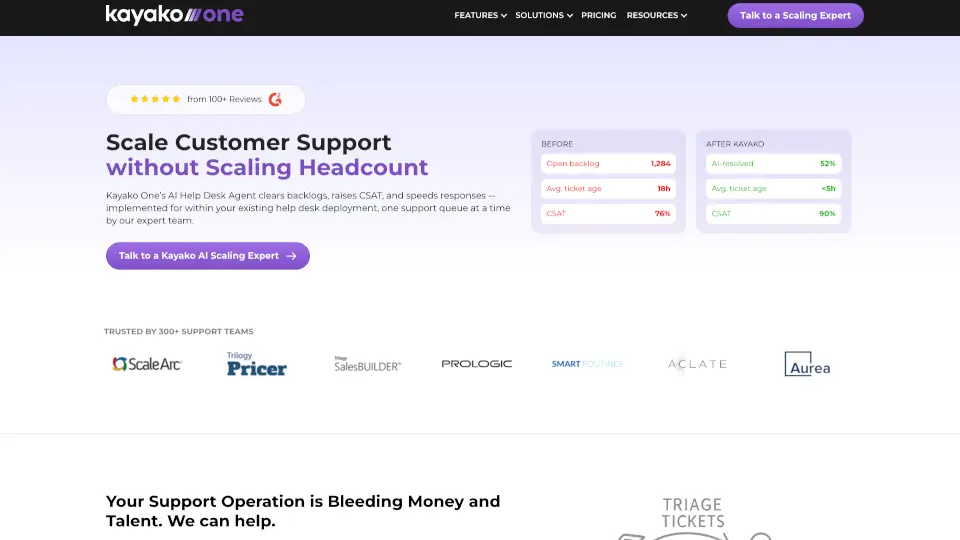

Kayako | 207.7K | 🇺🇸 United States30.2% | +2.3% | - | ⭐Medium Scale 100K-1M monthly visits. Growing tool with active development. | Kayako’s AI-powered help desk automates up to 80% of repetitive tasks, integrates effortlessly with your tools, and helps your team focus on what really matters—delivering exceptional customer experiences. |

AI Lending Network | Pagaya | 50.0K | 🇺🇸 United States64.1% | +21.2% | - | 📊Steady Growth Recent growth of 21%. Product is in a healthy upward trend. | Pagaya’s AI Lending Network helps financial partners approve more loans, grow customer relationships, and boost revenue—all without added risk. |

Conversica | 45.3K | 🇺🇸 United States91.3% | +48.5% | - | 📊Steady Growth Recent growth of 49%. Product is in a healthy upward trend. | Conversica’s AI-powered Revenue Digital Assistants help businesses engage leads, nurture opportunities, and retain customers with human-like conversations. It’s the ultimate tool for scaling your revenue efforts. |

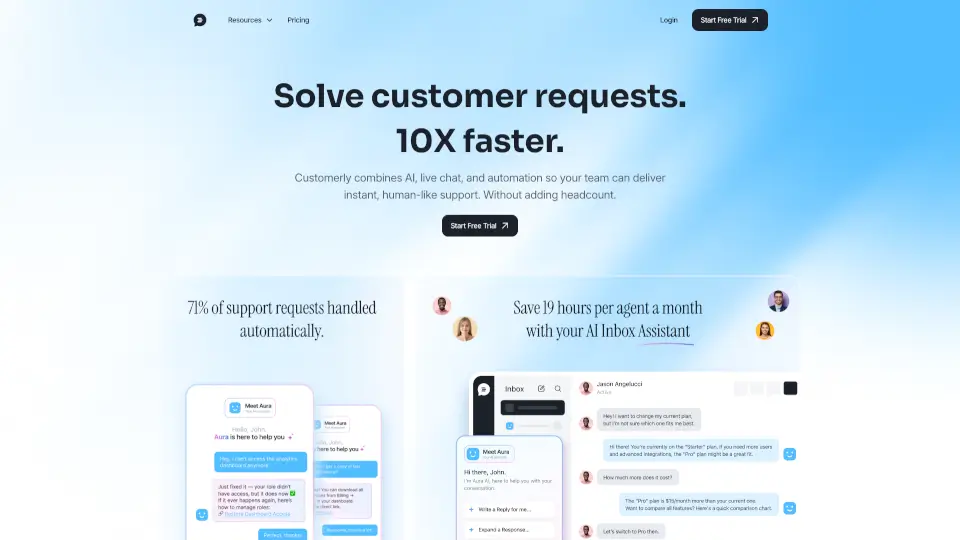

Customerly Ai | 43.8K | 🇺🇸 United States11.2% | -6.2% | - | 🌱Emerging Tool 10K-100K monthly visits. Niche or new tool with potential unique value. | Elevate your customer service with Customerly AI for automated, scalable, and satisfying engagement. |

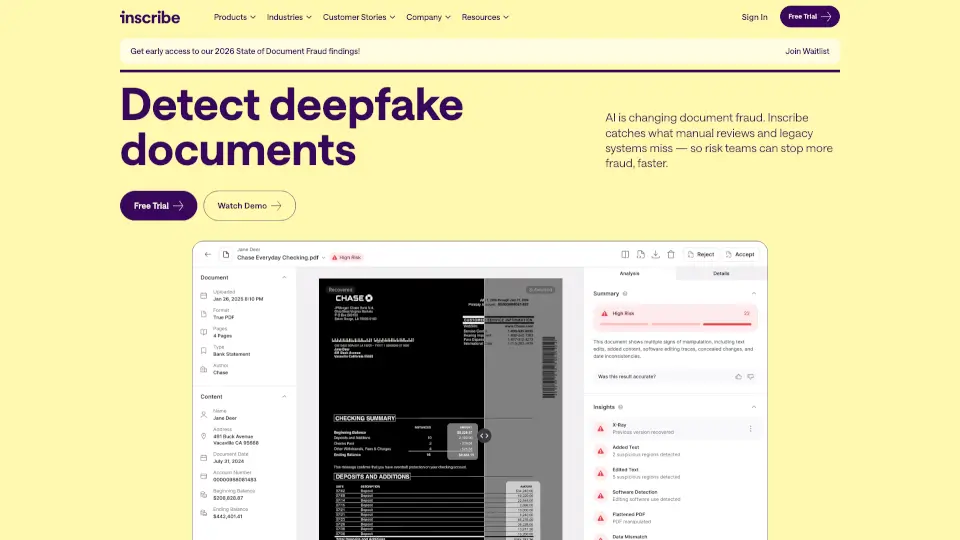

Inscribe | 38.2K | 🇺🇸 United States18.6% | +42.5% | - | 📊Steady Growth Recent growth of 43%. Product is in a healthy upward trend. | Inscribe is the ultimate tool for detecting document fraud and managing risks during onboarding and underwriting, powered by AI and machine learning. |

Top 11 Alternatives to Cascading AI

Elevate your customer service with Customerly AI for automated, scalable, and satisfying engagement.

OneFin LOS LMS is an AI-powered loan management system that streamlines the entire loan lifecycle for banks and NBFCs, from origination to management and collections.

Gradient Labs’ AI agent transforms financial customer ops with unmatched efficiency, compliance, and security.

Pagaya’s AI Lending Network helps financial partners approve more loans, grow customer relationships, and boost revenue—all without added risk.

Kayako’s AI-powered help desk automates up to 80% of repetitive tasks, integrates effortlessly with your tools, and helps your team focus on what really matters—delivering exceptional customer experiences.

Ocrolus automates document analysis, helping businesses make faster, more accurate financial decisions with AI-driven insights.

Conversica’s AI-powered Revenue Digital Assistants help businesses engage leads, nurture opportunities, and retain customers with human-like conversations. It’s the ultimate tool for scaling your revenue efforts.

Inscribe is the ultimate tool for detecting document fraud and managing risks during onboarding and underwriting, powered by AI and machine learning.

Evolution AI is an award-winning, AI-powered data extraction tool that automates financial document processing with high accuracy and ease. ---