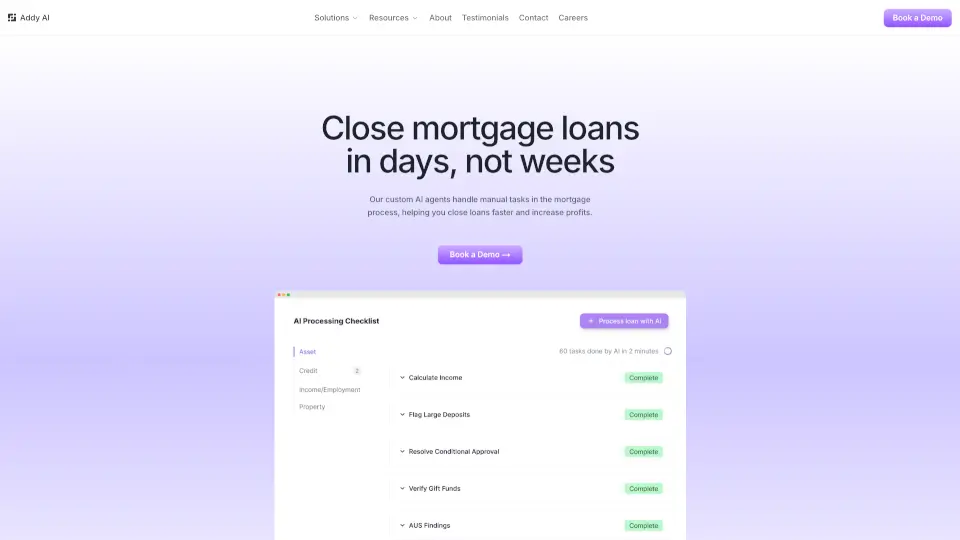

What is Addy AI?

Addy AI is a game-changer for mortgage lenders, helping them close loans faster and save time with custom AI models. It’s trusted by efficient lenders and banks to automate the loan origination process, making it 10 times faster than traditional methods.

What are the features of Addy AI?

- Instant Loan Assessments: AI checks loans instantly to ensure they meet credit policies and offers suggestions for eligibility.

- Data Extraction: Extracts relevant loan data from documents in seconds, including LTV and other key details.

- CRM Integration: Seamlessly connects with your CRM to sync and update loan data, boosting workflow efficiency.

- AI Chatbot: Train a specialized AI chatbot to answer mortgage lending guidelines instantly, available on Microsoft Teams or Slack.

- Client Follow-ups: Automates client follow-ups 24/7, ensuring a great experience in a competitive market.

What are the use cases of Addy AI?

- Faster Loan Origination: Achieve 90% faster loan processing with AI automation.

- Improved Client Satisfaction: Automate follow-ups and keep clients engaged.

- Enhanced Efficiency: Reduce manual tasks and focus on strategic work.

How to use Addy AI?

- Book a Demo: Start by booking a free demo to see Addy AI in action.

- Integrate with CRM: Connect Addy AI with your existing CRM for seamless data syncing.

- Train AI Models: Customize AI models to fit your specific mortgage lending needs.

- Deploy Chatbot: Add the AI chatbot to Microsoft Teams or Slack for instant guideline answers.