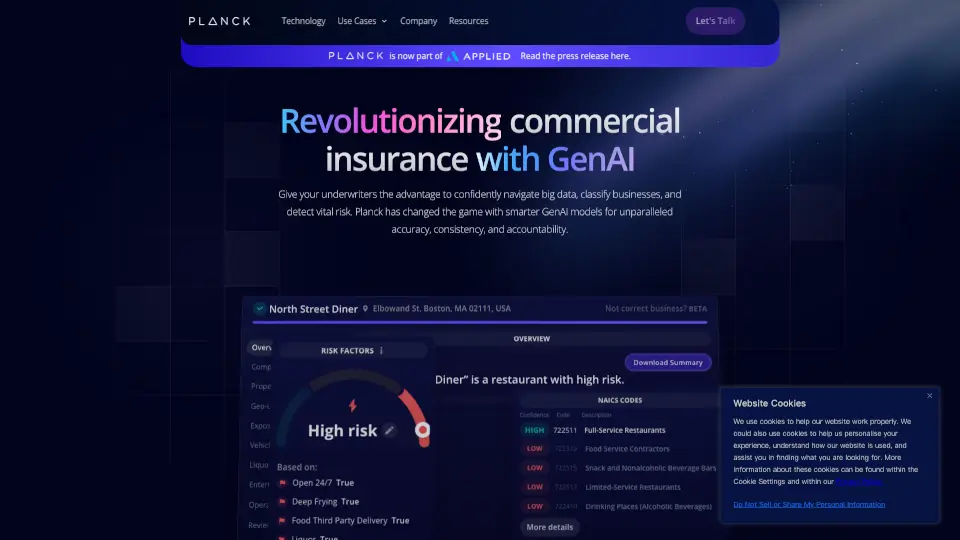

什麼是Planck Data?

Planck - Home 是一款革命性的商業保險核保工具,利用 GenAI 技術幫助核保人員更自信地處理大數據、分類企業並檢測關鍵風險。Planck 的智能模型提供了無與倫比的準確性、一致性和責任感,讓核保過程更加高效。

Planck Data的特色是什麼?

- GenAI 技術:結合多個神經網絡,深入理解模式、趨勢和關鍵風險。

- 風險評估:提供全面的業務風險評估,包括地理位置、財產信息和暴露風險。

- 數據分類:利用 GenAI 進行內容總結和分類,確保最高的市場準確性。

- 風險工作台:提供完整的業務特定風險評估,從提交到續保的整個核保過程。

- 企業解決方案:支持企業級 GenAI 整合,提升競爭優勢和市場份額。

Planck Data的使用案例有哪些?

- 餐廳和酒吧:Planck 目前專注於回答與餐廳、酒吧和酒館相關的問題,提供高精度的風險評估。

- 商業保險核保:幫助核保人員快速做出決策,減少手動分析的時間和錯誤。

- 企業整合:Planck PLUS 提供企業級解決方案,支持從營銷到核保自動化的整個保險流程。

如何使用Planck Data?

- PLUS Chat:通過 GenAI 聊天界面,核保人員可以提出任何與核保相關的問題,並獲得即時數據反饋。

- 風險工作台:使用 Planck 的風險工作台,深入了解業務風險,並根據戰略重點和最佳實踐進行評估。

- 企業整合:聯繫 Planck 團隊,了解如何將 GenAI 技術整合到您的企業中,提升核保效率和盈利能力。