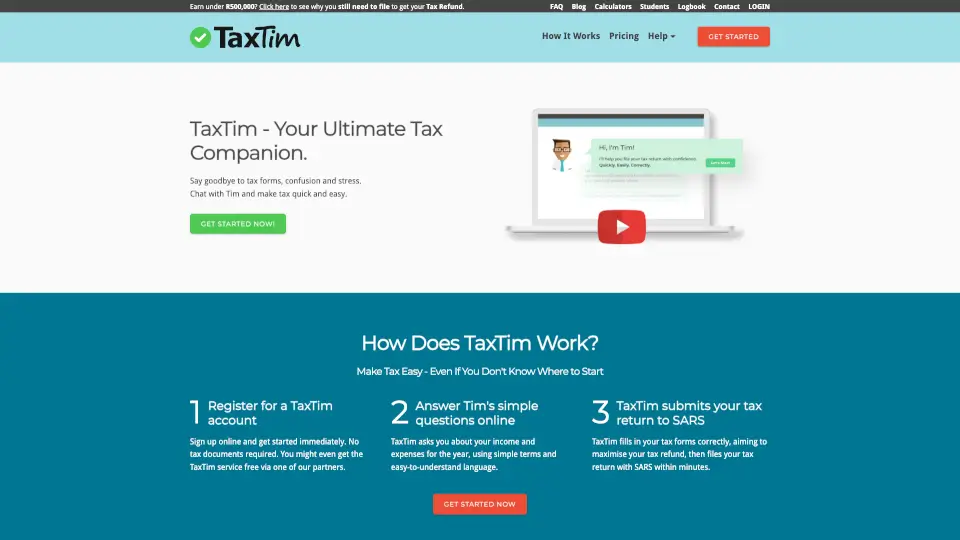

What is TaxTim SA?

TaxTim SA is your friendly online tax assistant that makes filing your tax return quick, easy, and stress-free. Whether you're a salaried employee, a freelancer, or a small business owner, TaxTim helps you maximize your refund and ensures you file correctly every time. With its simple, conversational approach, TaxTim guides you through the tax process in plain English, so you don’t need to be a tax expert to use it.

What are the features of TaxTim SA?

- Quick & Easy Filing: Complete your tax return in 20 minutes or less with TaxTim’s step-by-step questions.

- Maximize Your Refund: TaxTim’s built-in checks ensure you claim all possible deductions to get the maximum refund you deserve.

- Direct SARS Submission: TaxTim files your tax return directly to SARS with just one click, saving you time and hassle.

- Expert Support: Access tax practitioners via the online helpdesk for assistance with complicated tax questions.

- Secure & Trusted: Your data is protected with 256-bit SSL encryption, ensuring your information is safe.

- Personalized Tax Health Score: Get a free report with tips to optimize your taxes for next year.

What are the use cases of TaxTim SA?

- Salaried Employees: File your tax return quickly if you earn a basic salary.

- Freelancers & Independent Contractors: Claim deductions for business expenses and income.

- Small Business Owners: File turnover tax or company tax returns with ease.

- Rental Income Earners: Declare rental income and claim deductions for property expenses.

- Foreign Income Earners: Report foreign employment, trade, or investment income.

How to use TaxTim SA?

- Register for Free: Sign up for a TaxTim account online. No tax documents needed to start.

- Answer Simple Questions: TaxTim asks about your income and expenses in plain English.

- Get Your Tax Forms: TaxTim fills in your tax forms correctly and checks for missed deductions.

- Submit to SARS: File your tax return directly to SARS with one click.