What is Brex?

Brex is a modern finance platform designed to help businesses, especially startups and mid-size companies, manage their finances more efficiently. With Brex, you can handle everything from corporate cards and banking to expense management and travel, all in one place. The platform uses AI to automate many of the tedious financial tasks, making it easier for you to focus on growing your business. Whether you're a small startup or a large enterprise, Brex offers tools that can help you save time, reduce errors, and make better financial decisions.

What are the features of Brex?

- Corporate Cards: Spend smart globally with powerful cards and built-in controls.

- Expense Management: Use AI to automate approvals and expense reports, tracking in real time.

- Travel Management: Simplify global travel with in-app booking and management.

- Bill Pay: Save time with AI-powered invoice entry and payment automation.

- Banking and Treasury: Save, spend, and grow your cash with up to 3.72%† — from day one.

- AI-Powered Automation: Automate financial operations to maximize resources and control spending.

What are the use cases of Brex?

- Startups: Get the only complete financial stack designed to help start and scale your business.

- Mid-Size Companies: Spend smarter worldwide with AI-powered budgets, expenses, payments, and travel.

- Enterprises: Simplify global travel and expenses with automation that makes compliance easy.

- Remote Teams: Manage and track expenses for remote employees with ease.

- Freelancers and Consultants: Streamline invoicing and payment processes for multiple clients.

- E-commerce Businesses: Handle international transactions and manage inventory costs efficiently.

How to use Brex?

- Sign Up: Create an account on the Brex website and provide the necessary business information.

- Set Up Cards: Issue corporate cards to your team members with customized spending limits.

- Configure Controls: Set up spending policies and controls to ensure compliance.

- Integrate with ERP: Connect Brex with your existing accounting and ERP systems for seamless data flow.

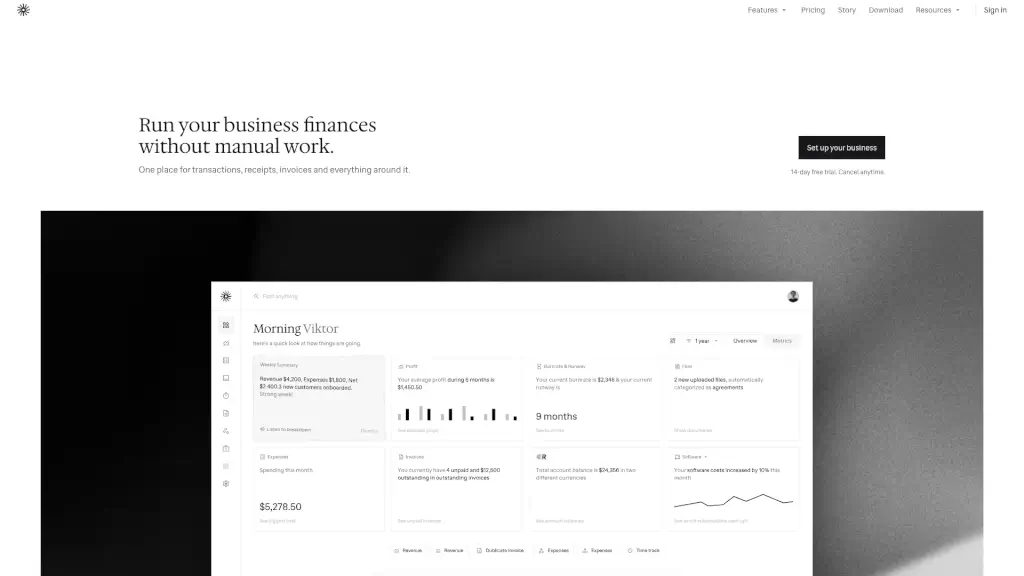

- Monitor and Adjust: Use the real-time dashboard to track spending and adjust budgets as needed.

- Automate Payments: Set up automatic bill payments and invoice processing to save time.